To calculate the total cost of production, you can add the total fixed and variable costs.

CALCULATE TOTAL VARIABLE COST HOW TO

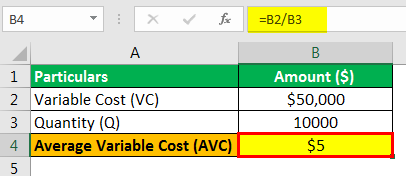

Read more: How to Calculate Variable Cost with Examples 3. The accountant combines these values to determine the total variable costs of $197,000. The manufacturing company's accountant reviews its financial documents to determine it has $52,000 in raw materials, $124,000 in direct labour costs, and $21,000 in shipping charges. Here's a continuation of the above example to show how you can determine variable costs: Combine all variable costs, such as the cost of raw materials, direct labour, sales commissions, and shipping charges.

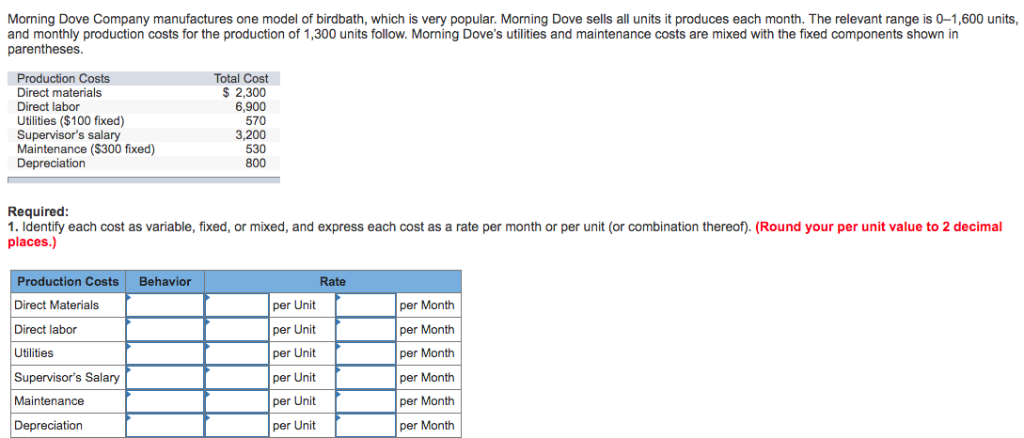

You can identify the variable costs by reviewing the same financial documents. Read more: All You Need to Know about How to Calculate Fixed Cost 2. The accountant combines these values to determine total fixed costs of $344,000. Here's an example of identifying fixed costs:Ī manufacturing company's accountant reviews its profit and loss account to determine it has $150,000 in equipment leases, $37,000 in property taxes, and $157,000 in rent and utilities. Combine the fixed costs, such as rent expenses, equipment costs, insurance, salaries, and utilities. You can determine a company's fixed costs by evaluating the profit and loss account or business balance sheets. Here are the steps that outline how to calculate total cost: 1. Related: FAQs: Plant, Property, and Equipment (PP and E) Assets How to calculate total cost Here's the formula for calculating the average total cost:Īverage total cost = (Total fixed costs + Total variable costs) / Number of units produced Since the total fixed cost doesn't change, the change in average variable cost influences the change in average total cost. Variable costs might increase or decrease based on the output, including items such as direct labour or the cost of materials used to create products.

This includes the facility costs and manufacturing equipment purchased, often under the title of plant, property, and equipment (PPE) assets. The average total cost measures the total cost of production per each unit produced, considering both fixed and variable costs.įixed costs are those that are necessary for production and remain constant regardless of the number of goods produced. Production managers use the average total cost to evaluate which level of production can increase profitability. In order for a company to be profitable, businesses price products above the average total cost. Business and financial managers might use this information to make decisions on product pricing. The average total cost is the per-unit cost of the number of products that are made. In this article, we define the average total cost, explain the steps for calculating it, explore the differences between other types of production costs, and provide an example. Understanding how to calculate this value can help you evaluate cost structures, create plans, and implement profitable production budgets. Considering the fixed and variable costs associated with production in relation to the total number of goods you're producing can help you evaluate the average total cost. Determining the average total cost is important for pricing products and services, as it ensures companies are pricing their products high enough to generate a profit.

0 kommentar(er)

0 kommentar(er)